Content

The amortization and impairment loss recognized in the reporting period. The method used to determine amortization for each reporting period. The disclosures must contain sufficient information to convey the relationship between disaggregated revenue and each disclosed segment’s revenue information.

- However, we expect diversity in practice to lessen as more entities adopt the standard and as entities evaluate their peers’ filings.

- Recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

- You record it under short-term liabilities (or long-term liabilities where applicable).

- Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered.

- The business has not yet performed the service or sent the products paid for.

Some examples of unearned revenue include advance rent payments, annual subscriptions for a software license, and prepaid insurance. The recognition of deferred revenue is quite common for insurance companies and software as a service companies. Unearned revenue refers to revenue your company or business received for products or services you are yet to deliver or provide to the buyer . Therefore, businesses that accept prepayments or upfront cash before delivering products or services to customers have unearned revenue. There are several industries where prepaid revenue usually occurs, such as subscription-based software, retainer agreements, airline tickets, and prepaid insurance. Unearned revenue is usually disclosed as a current liability on a company’s balance sheet. This changes if advance payments are made for services or goods due to be provided 12 months or more after the payment date.

Accounting For Unearned Revenue

This section outlines requirements related to the Closing Procedures – Accruals, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes and pitfalls which can be remedied quickly and prevent larger issues in the future.

Where is the deferred revenue account reported in the financial statements?

Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement. Instead they are reported on the balance sheet as a liability. As the income is earned, the liability is decreased and recognized as income.

In proprietary funds, report revenues in the statement of revenues, expenses and changes in net position and the statement of activities as soon as they are earned. Report unearned revenues as a liability for derived tax revenues received in advance . ProfitWell Recognized allows you to customize your financial reporting and statements. For example, you can use it to set standard controls, rules, and methods to recognize revenue in a particular way.

Fasb, Financial Accounting Standards Board

On payday, the entry to salaries payable is reversed and cash is reduced. For more information, please refer to the Payments to Employees section. In the illustration for insurance, the adjustment was applied at the end of December, but the rent adjustment occurred at the end of March. What was not stated in the first illustration was an assumption that financial statements were only being prepared at the end of the year, in which case the adjustments were only needed at that time. In the second illustration, it was explicitly stated that financial statements were to be prepared at the end of March, and that necessitated an end of March adjustment. A proprietary fund recognizes revenues using the full accrual basis of accounting. In governmental funds, report deferred inflows of resources in the statement of net position for intra-entity sales of future revenues between the primary government and component unit .

Conversely, GAAP requires that certain line items be broken out into current and long-term components . However, for forecasting purposes, they can be combined because they are forecast using the same drivers. Is prepared by members of Deloitte’s National Office as developments warrant. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

Company

He is the sole author of all the materials on AccountingCoach.com. By subscribing, you agree to ProfitWell’s terms of service and privacy policy. Subscription software helping you achieve faster recurring revenue growth. unearned revenue is reported in the financial statements as: Learn about the factors of production, how land, labor, capital and entrepreneurship impact the economy, and examples. The best type of business organization depends on the type of business being conducted.

They’re usually salaries payable, expense payable, short term loans etc. Unrecorded revenue goes against the matching principle of accounting as it results in revenue being recorded in a later period than it was actually earned. Unearned revenue is the cash obtained from a customer in advance of providing the goods or services they are purchasing. A governmental fund recognizes revenues in the accounting period the revenues become both measurable and available to finance expenditures of the fiscal period. The same amounts of receivables are recognized under either the modified or full accrual basis.

If the accrued expenses are largely for expenses that will be classified as SG&A, grow with SG&A. All forecasting needs to be done in supporting schedules — either in the same worksheet or in dedicated separate worksheets. This is where the forecasting and calculations should take place. The consolidated balance sheet simply pulls the finished product — the forecasts — to present a complete picture. See Sections 13.2and13.3of Deloitte’sRevenue Roadmapfor more information about contract liabilities and contract assets, respectively. There was no impairment recorded on capitalized contract costs in the first quarter of 2018. The example below illustrates a disclosure related to costs incurred to obtain and fulfill a revenue contract.

What Type Of Account Is Unearned Revenue?

The closing balances of assets recognized from the costs incurred to obtain or fulfill a contract, by asset category. Disclosure Examples 12 through 14 below illustrate the application of the practical expedients related to disclosure of the remaining performance obligations and disclosure of the remaining performance obligations. There was diversity in how the entities in our sample chose to meet the contract balance disclosure requirements. We observed that approximately 60 percent of the entities in our sample disclosed that they had significant contract balances. Of those, 55 percent chose to present the disclosures in a tabular format, with the remainder providing the disclosures in a narrative format.

Evolving Systems Reports Third Quarter 2021 Financial Results – GlobeNewswire

Evolving Systems Reports Third Quarter 2021 Financial Results.

Posted: Wed, 10 Nov 2021 08:00:00 GMT [source]

This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website. To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content.

In these cases, the unearned revenue should usually be recorded as a long-term liability. In which revenue is recognized only when the payment has been received by a company AND the products or services have not yet been delivered to the customer.

Adjusted Trial Balance

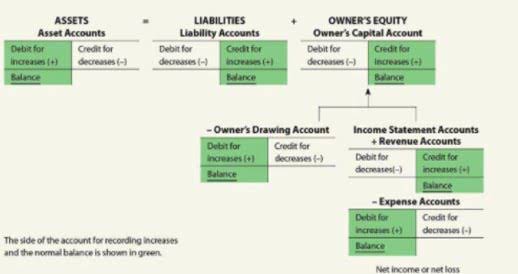

This method differs from the cash basis method which records revenues and expenses only when monies are exchanged. Unearned revenue, sometimes referred to as deferred revenue, represents advance payments a company receives for goods or services that have not yet been provided. Using accrual accounting, or double-entry accounting, you’ll need to record unearned revenue as a liability. Several types of accounts—specifically, revenues, expenses, gains, losses, and dividends paid—reflect the various changes that occur in a company’s net assets but just for the current period.

That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team.

- First, the item type must belong to an item type group defined for this purpose.

- Unearned service revenue is income received by companies as payment for services or products to be provided in the near future.

- The receipt of revenue is balanced with a decrease in assets, such as inventory or the value of services.

- Recognize the revenue when the business satisfies the obligation.

- Note that when the delivery of goods or services is complete, the revenue recognized previously as a liability is recorded as revenue (i.e., the unearned revenue is then earned).

Unearned revenue can provide clues into future revenue, although investors should note the balance change could be due to a change in the business. Morningstar increased quarterly and monthly invoices but is less reliant on up-front payments from annual invoices, meaning the balance has been growing more slowly than in the past.

The payment is not included in the company’s gross revenues, which is reflected in the number called the “top line” located at the start of the income statement. Unearned service revenue remains on the income statement until the work is actually performed, after which the cash payment is recorded as revenue, and resources used to provide the service are listed as a business expense. Accounts receivable, which are included in accounts receivable, other current assets and other long-term assets on the consolidated balance sheets, increased by $ million, mainly due to timing. Contract liabilities — long-term, which are included in deferred credits and other long-term liabilities on the consolidated balance sheets, increased by $ million, mainly due to receipts for which recognition will be long-term.

What is revenues in accounting?

Revenue is the total amount of income generated by the sale of goods or services related to the company’s primary operations. Revenue, also known as gross sales, is often referred to as the “top line” because it sits at the top of the income statement. Income, or net income, is a company’s total earnings or profit.

Hence, you record prepaid revenue as an equal decrease in unearned revenue and increase in revenue . It’s categorized as a current liability on a business’s balance sheet, a common financial statement in accounting. An adjusting journal entry occurs at the end of a reporting period to record any unrecognized income or expenses for the period.

How To Calculate Unearned Revenue With Examples

There are a few additional factors to keep in mind for public companies. Securities and Exchange Commission regarding revenue recognition. This includes collection probability, which means that the company must be able to reasonably estimate how likely the project is to be completed. There should be evidence of the arrangement, a predetermined price, and realistic delivery schedule. Unearned revenue represents a business liability that goes into the current liability section of the business’ balance sheet. ProfitWell Recognized allows you to minimize and even eliminate human errors resulting from manual balance sheet entries.

The entry to record the unearned revenue is made outside of the 2nd Quarter financial statement. This entry is recorded centrally outside of KFS and units are not expected to make any manual adjustments. Advance payments are beneficial for small businesses, who benefit from an infusion of cash flow to provide the future services. An unearned revenue journal entry reflects this influx of cash, which has been essentially earned on credit. Once the prepaid service or product is delivered, it transfers over as revenue on the income statement. Disclosures about significant judgments and estimates in the application of revenue recognition guidance are expected to increase as entities adopt ASC 606. We observed that many entities in our sample included such disclosures in the significant accounting policies or the management estimates section of their footnotes, or as part of the revenue footnote.

Furthermore, that will also lead to a violation of the Matching Principle of accounting for unearned income, which requires that both expense and related income should be reported in the same period to which it belongs. Unearned income or deferred income is a receipt of money before it has been earned. This is also referred to as deferred revenues or customer deposits.

You record prepaid revenue as soon as you receive it in your company’s balance sheet but as a liability. Therefore, you will debit the cash entry and credit unearned revenue under current liabilities. After you provide the products or services, you will adjust the journal entry once you recognize the money. At this point, you will debit unearned revenue and credit revenue. A similar asset is recorded if a company pays for rent in advance. Conceptually, it would make sense to make a journal entry at the end of each day to record the using up of $3.29 of the Prepaid Insurance asset.

Katapult Announces Third Quarter 2021 Financial Results – GlobeNewswire

Katapult Announces Third Quarter 2021 Financial Results.

Posted: Tue, 09 Nov 2021 08:00:00 GMT [source]

Accrued Vacation & Sick Liability (9056 & 9058) – Annually, a calculation is made to record the university’s Accrued Vacation and Sick Liability. The entry is based on a number of factors including salary plan, age, years of service, rate of pay, and vacation balances. Typically, this entry is booked in the latter part of June and reversed in June of the following year. Liability amounts are recorded for vacation, sick, employer contributions for vacation and sick, and an employer contribution for Federal Insurance Contributions Act .

Author: Jody Linick